hmrc pay tax bill

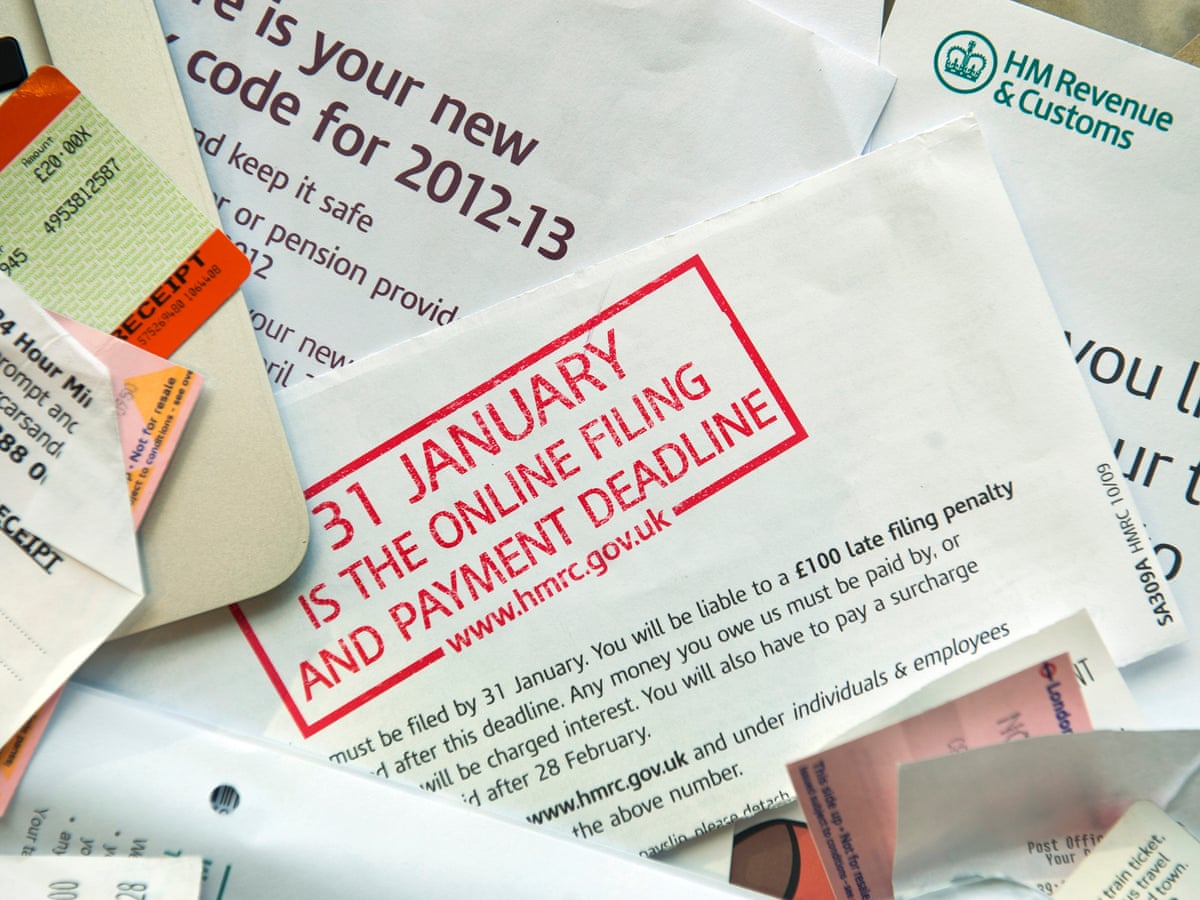

To make a single CHAPS payment to cover a number of Self Assessment references called a multiple or composite payment contact your HMRC. This year HMRC has increased the threshold from 10000 to 30000 resulting in over 25000 people signing up and setting up the payment plans.

What To Do If You Ve Made A Mistake On Your Tax Return Mirror Online

Given as a concession it is there to help individuals and businesses in repaying tax bills at an agreed monthly figure over.

. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at 8888072111 or 2139742111 press 1 2 and then press 9 to reach an agent Monday Friday 800am. Adjusted Secured Property Tax Bill - The Adjusted Secured Property Tax Bill replaces the Annual Secured Property Tax Bill. Youll have to use the paying-in slip that is sent to you via post.

Done correctly these could potentially remove the need to pay inheritance tax altogether. You may be able to pay your tax bill in instalments. The number is 0300 200 3822 and its open Monday to Friday 8am to 4pm.

Annual Secured Property Tax Bills - The Annual Secured Property Tax Bill is mailed on or before November 1 of each year. In simple assessment an individual receives a calculation of tax to pay for the tax year by HMRC. Once they have filed their 2020 to 2021 tax.

Create a free Billhop account. How to pay HMRC with Billhop. If you receive your statement from the HMRC in paper form with your tax bill on it you can pay in person at your bank.

Then write your 11 digit reference on the back of the cheque. California State law requires the reassessment of property as of the first day of the month following an ownership change or the completion of new construction. The first installment payment is due November 1.

Those unable to pay their tax bill can split their bill into smaller instalments using HMRCs Time to Pay service. The HMRC payment plan is called a Time to Pay TTP whereby taxpayers can use instalment arrangements to pay their self-assessment tax bills to help spread the cost. You can pay your Simple Assessment bill online with a debit or corporate credit card.

Ways to pay HMRC You can choose to pay your Self Assessment tax bill online or by telephone banking by debit or corporate card online not personal credit card or CHAPS. The annual bill has two payment stubs. More than 122 million customers are expected to complete a tax return for the 202021 tax year according to HMRC.

Write that your cheque is payable to HM Revenue and Customs only. If you cannot afford to pay your tax bill in full contact HMRC as soon as you can. This is called a Time to Pay arrangement.

Almost 100000 Self Assessment customers have used online payment plans to spread the cost of their tax bill into manageable monthly instalments since April 2021 HM Revenue and Customs HMRC has. 1 day agoHowever taxpayers can minimise their potential inheritance tax bill in a number of ways. Fill in your tax bill details.

The 22nd of the next tax month if you pay monthly the 22nd after the end of the quarter if you pay quarterly -. When youre ready to pay start your Simple Assessment payment. HMRC supports taxpayers who may need help with their tax liabilities and cannot pay in full.

It becomes delinquent and will be subject to a 10 percent penalty if payment is not received or postmarked by the United States Postal Service USPS on or before December. A Time to Pay Arrangement is a monthly re-payment arrangement with HMRC. Annual property taxes may be adjusted during the fiscal year July 1 through June 30.

If you need to speak to HMRC to set up a plan you can use the Self Assessment payment helpline. Theres certain criteria youll have to meet before youre allowed to. 1 a change or correction to the assessed value of the property 2 the allowance of an exemption that was previously.

HMRC make it simple by calculating the tax to pay by taxpayer. Add credit card and confirm payment. The NAO reported on Thursday that HMRC estimated two years after the public sector changes that an additional 50000 people were on the payroll.

So if youre thinking I cant pay my tax bill dont ignore the situationIts best to get in touch with the tax authority to see if you can agree to an HMRC payment plan. Dec 13 2021 HMRC Time to Pay is a service you can use to pay a tax bill in instalments. Ask about Time to Pay.

Select the corporate credit card or debit. An Easy Way to HMRC Simple Assessment and Payment of Tax Bill Self-assessment is a system by which HMRC collects the tax amount. If you have received a paying-in slip from HMRC you can also choose to walk into a bank or a building society and make the payment.

If you cant pay a different type of tax look for contact details on any communication youve had from HMRC about the bill. You must pay your PAYE bill to HM Revenue and Customs HMRC by. Self assessment taxpayers with up to 30000 of tax debt can do this online once they have filed their return.

Supplemental Property Bill - Supplemental Property Bill to the Annual Secured Property Tax Bill and both must be paid by the date shown on the bill. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. Reasons may include one or more of the following.

10 Ways To Cut Your Tax Bill Tax The Guardian

How To File Your Uk Taxes When You Live Abroad Expatica

Paying Hmrc Tax Bills Response From Hmrc In Reply To First Response

Self Assessment Tax Return And Payments Inniaccounts

Dan Neidle On Twitter Last Year Hmrc Sent Me A Penalty For Late Filing Of A Tax Return Which I Had Filed In Good Time This Year They Ve Been Much More Efficient

Hmrc Payment Problems Worried Directors Guide Company Rescue

0 Response to "hmrc pay tax bill"

Post a Comment